KYC Flow Revamp: Boosting Activation Rates

TL;DR

- For every new investor, the first trade is crucial to activate their wealth-building journey.

-

Friction and complexity in the KYC process led to low activation rates, impacting business goals.

- By implementing impactful, low-effort improvements, we achieved a 2.75x increase in activation.

- Cross-team collaboration ensured a cohesive and effective solution.

Context

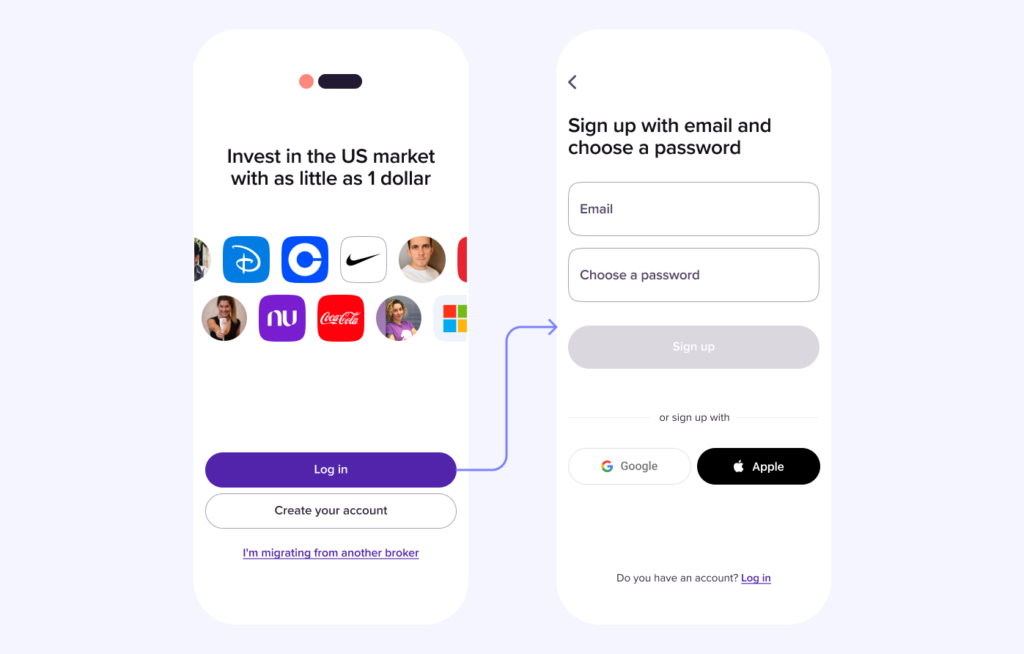

Vest is a regulated broker-dealer in the USA that connects Latin American investors with the US stock market. To invest, users must open an account by providing personal information through the KYC (Know Your Customer) process.

Users often hesitate to fully engage with an investment app, but completing their first trade helps overcome initial fears. This milestone qualifies them as active users, who then gain confidence and eagerness to explore, driving both engagement and business growth.

The challenge

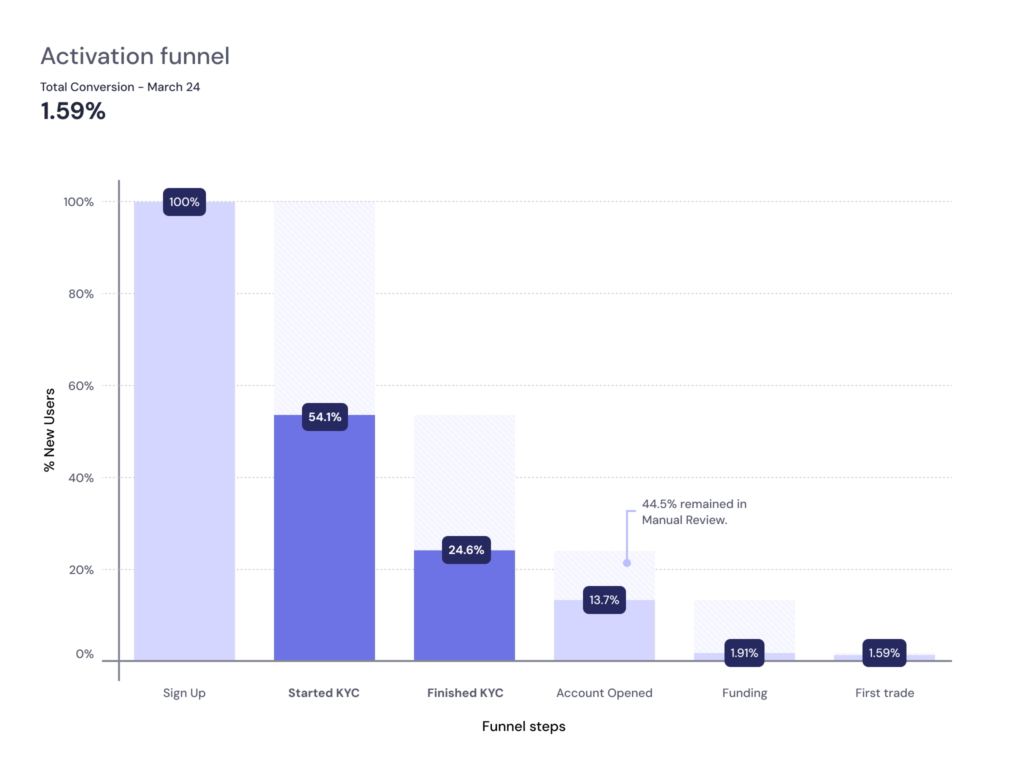

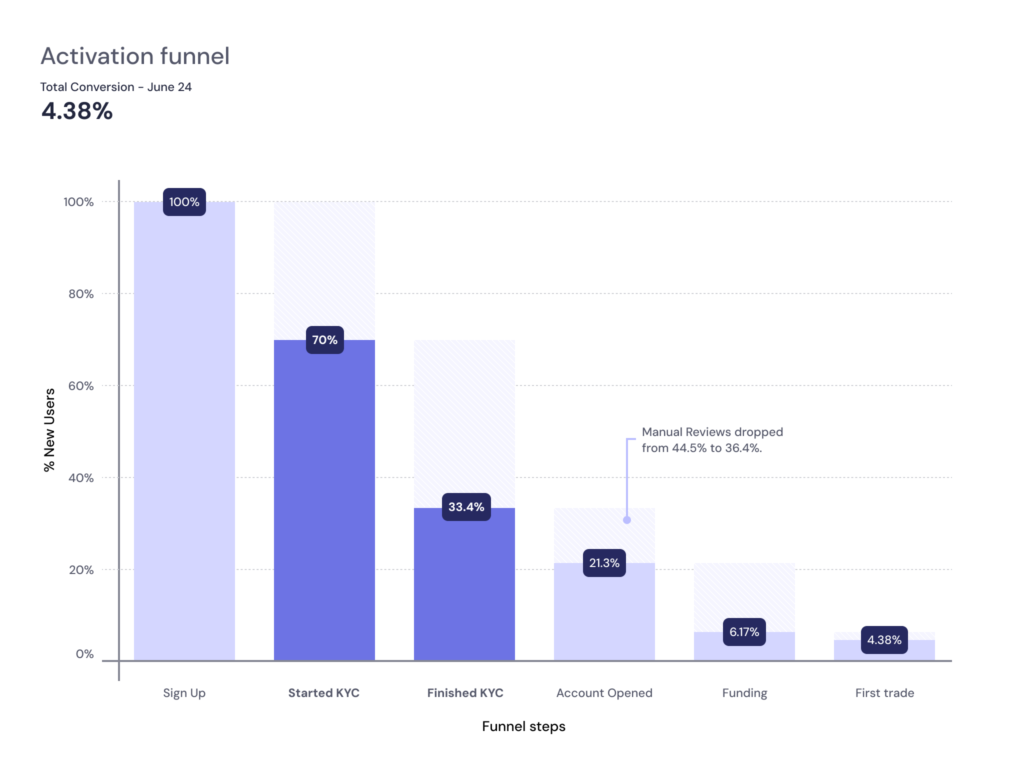

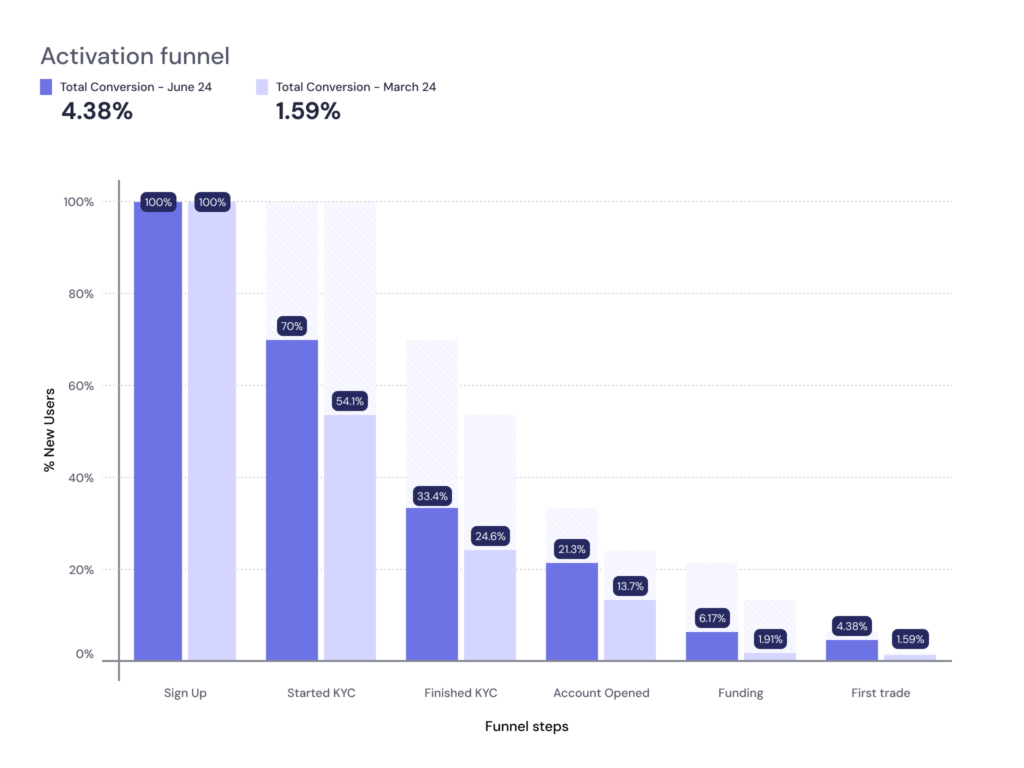

By March 2024, the activation rate was just 1.59%, with the largest drop-offs during the KYC flow. Only 13.7% of users successfully opened their investment accounts.

We weren’t engaging users effectively, missing the chance to help them build wealth, and losing significant business opportunities.

Unstarted KYC and User Drop-offs

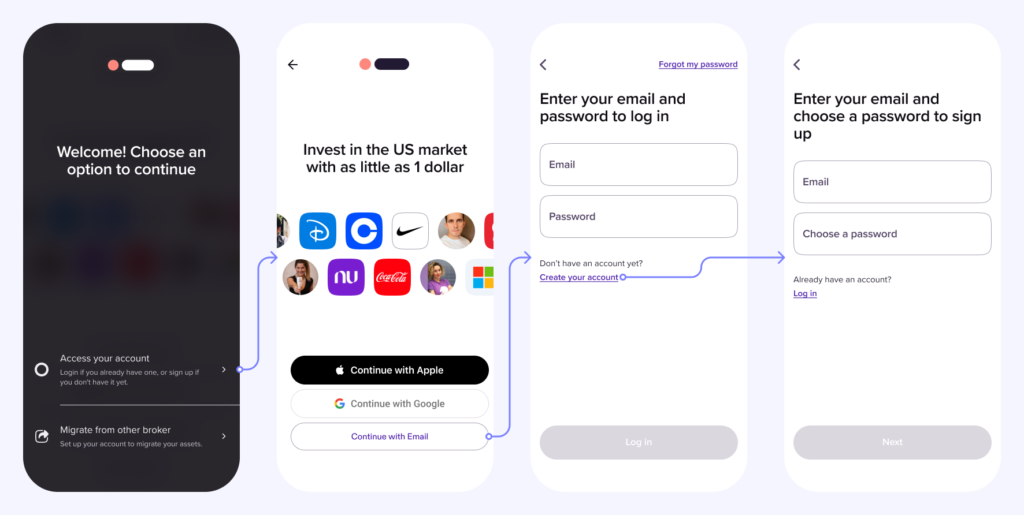

By running usability testing sessions on the app flow, we identified issues that added friction and complexity to the user experience.

Manual reviews

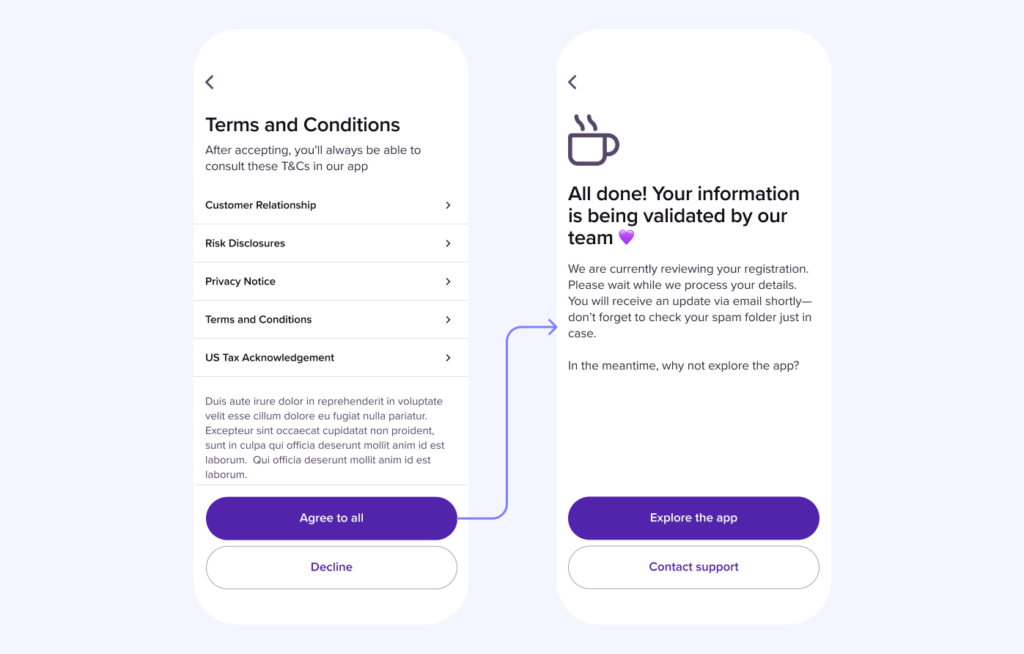

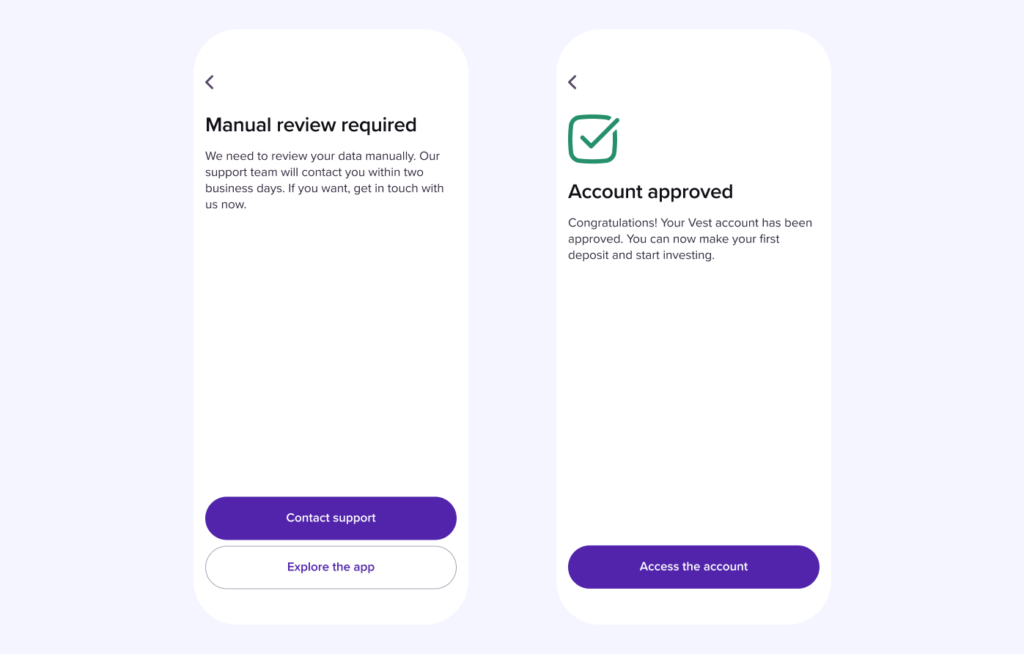

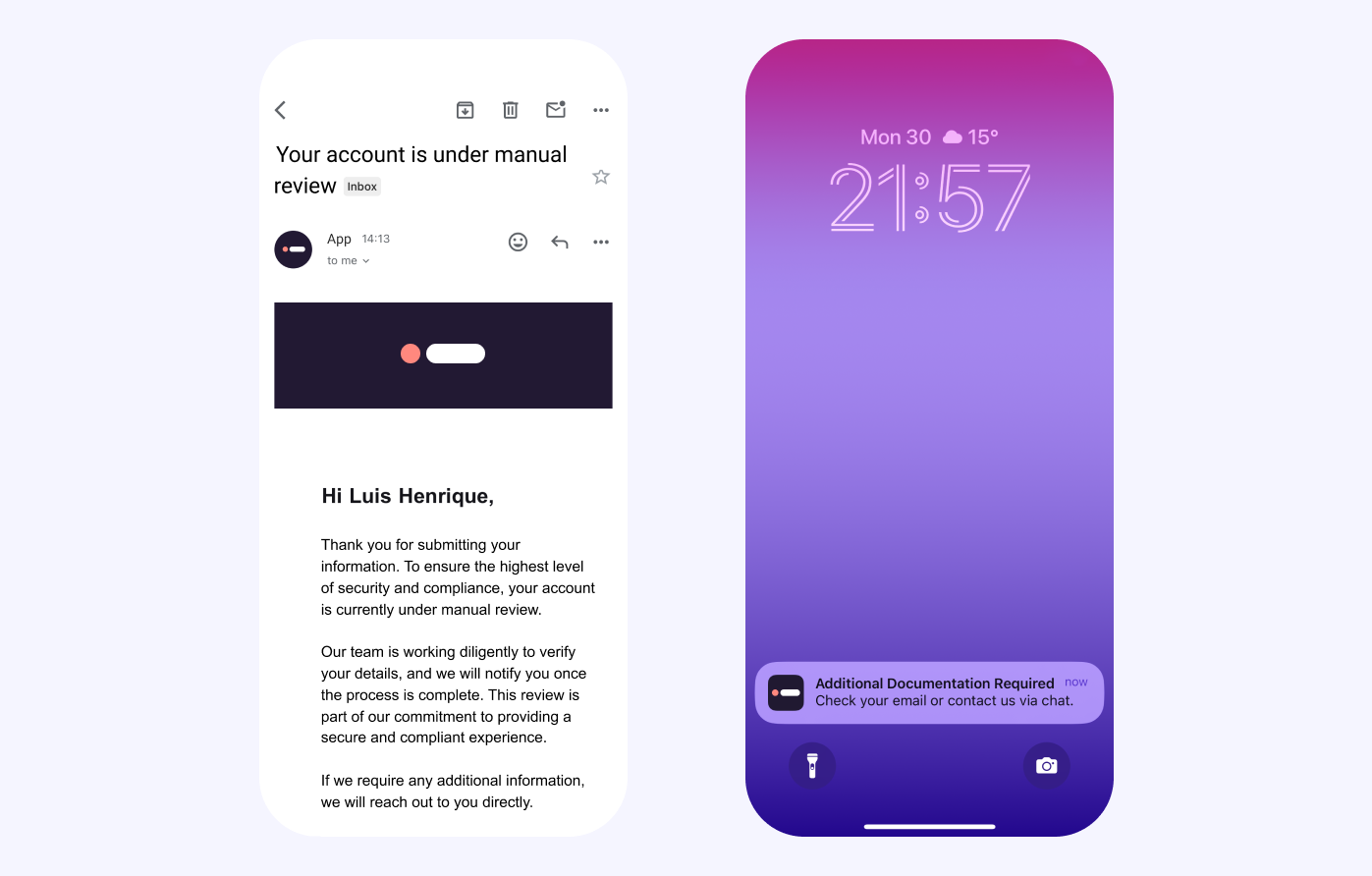

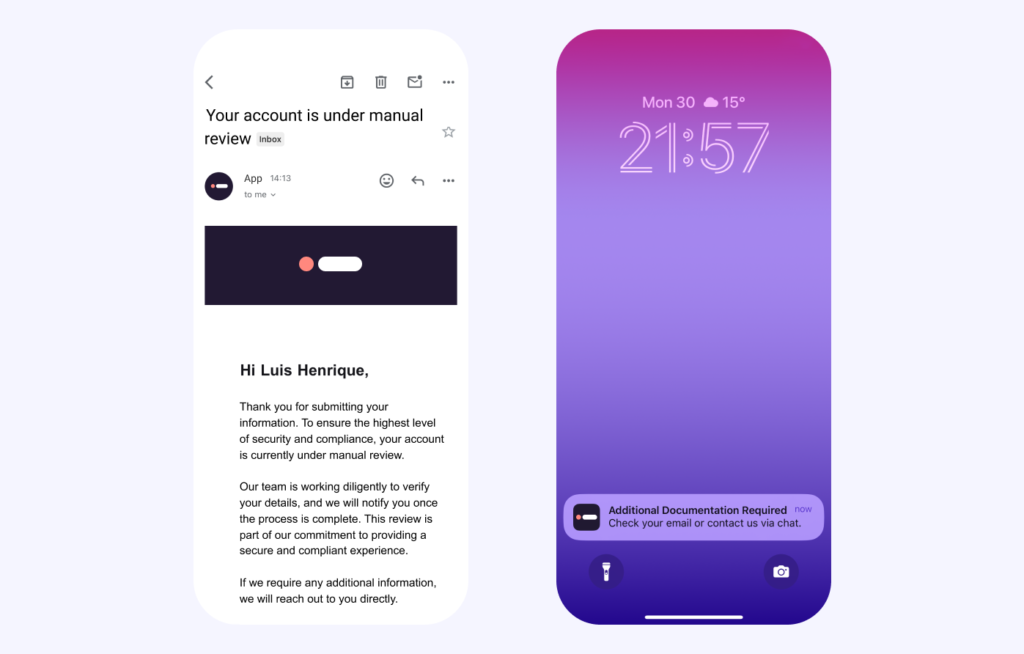

When the automated process in the app is not completed due to failed ID verifications or alerts from compliance checks, the Customer Success team intervenes.

These were the main issues identified:

- Lost Cases: For specific cases, the status was not being updated. We identified this issue thanks to users who reached out.

- Expired IDs or Blurry Photos: It prevented our system from verifying users, requiring the Customer Success team to request new photos.

- Missed Requests: Users were not seeing messages from Customer Success because the notifications only appeared in the support chat.

Solution

With a four-week deadline, Marketing, Customer Success, and Product teams worked together to assess the effort versus the impact of potential solutions.

Numerous trade-offs were made to maximize impact. Even after the plan was defined, we had to adjust the course due to unforeseen complexities.

Here’s what we delivered:

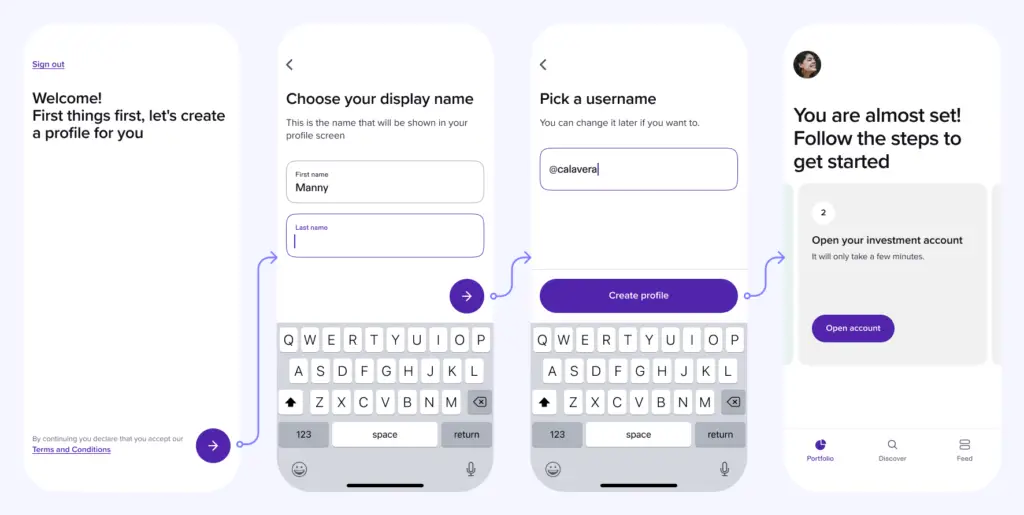

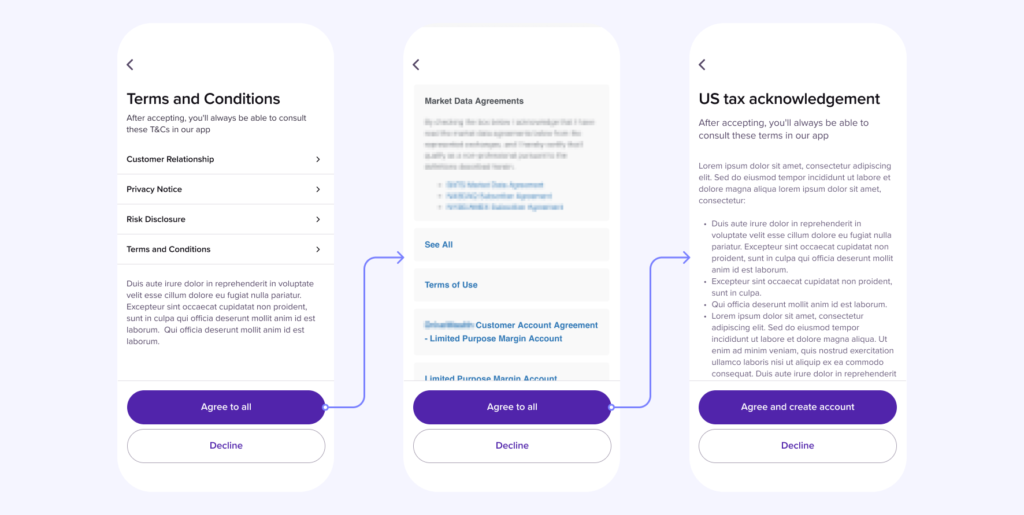

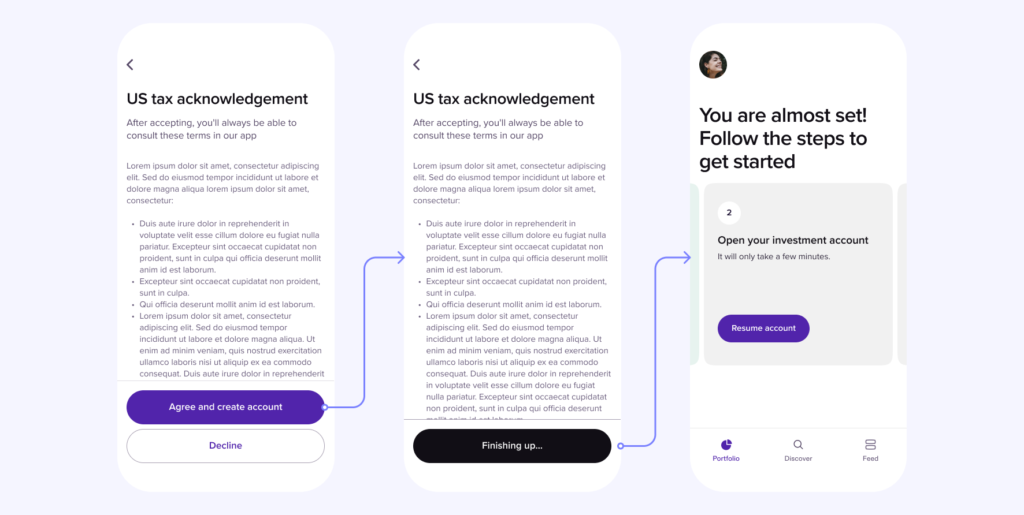

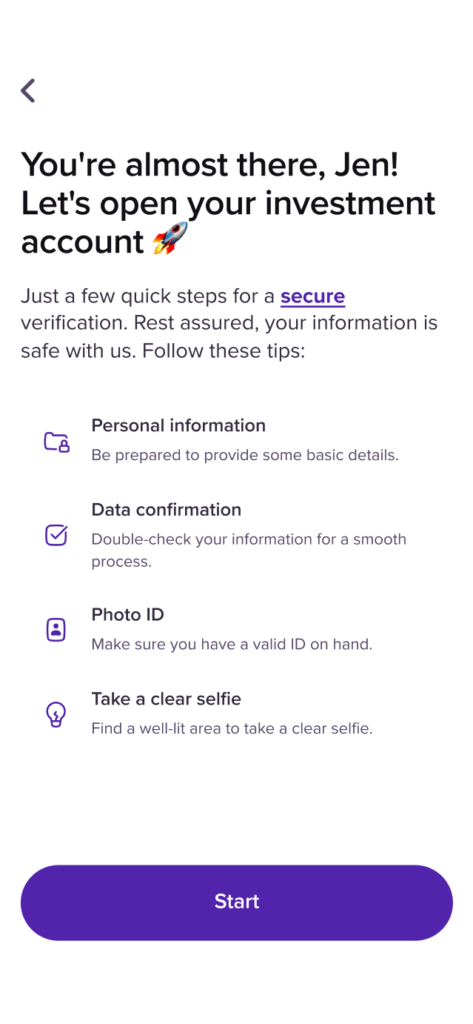

2. New intro screens

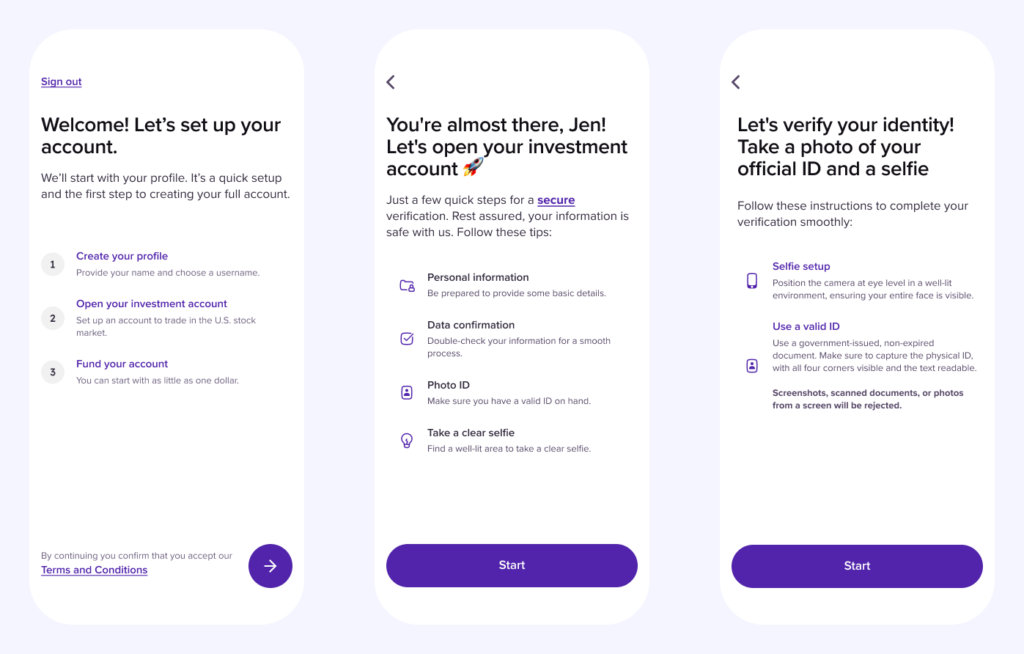

- Welcome screen: Before profile creation, introduce the activation steps and explain the differences between them.

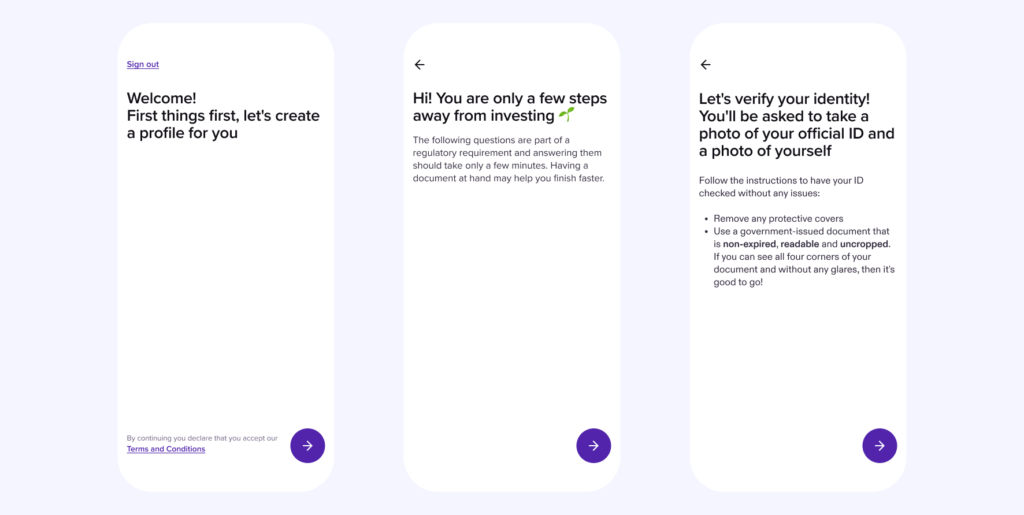

- KYC flow: Explain the process, why it’s necessary, and how it benefits the user.

- ID photos: List the requirements and provide instructions to reduce the likelihood of manual review.

6. Fix for Manual reviews cases

We implemented the backend fix to ensure all manual reviews are properly tagged, allowing Customer Success to effectively follow up on all cases.

2. New intro screens

1. Welcome screen: Before profile creation, introduce the activation steps and explain the differences between them.

2. KYC flow: Explain the process, why it’s necessary, and how it benefits the user.

3. ID photos: List the requirements and provide instructions to reduce the likelihood of manual review.

6. Fix for Manual reviews cases

Results

By June 2024, our activation rate reached 4.38%, more than doubling the previous rate. Additionally, 70% of users are now starting the KYC process, and the percentage of users in Manual Review has dropped from 44.5% to 36.4%.

The percentage of users opening their investment accounts increased from 13.7% to 21.3%. This solution streamlined the process and helped users move closer to achieving their investment goals.

Final thoughts

This experience was incredibly rewarding. Involving various team members responsible for different touchpoints in the customer journey was key to our success, resulting in an integrated and cohesive solution.

Selecting the “right bets” was challenging; we had to maintain focus amid numerous issues, which made it easy to stray into less critical improvements. While many changes still need to be made, this solution is making a significant impact and sets a strong foundation for future development.

Robo-Investing: Freeing Users from Choice Overload