Robo-Investing: Freeing Users from Choice Overload

TL;DR

- In the investment world, fear of loss and lack of time are common barriers to starting investments.

- Vest implemented a robo-investing feature to free users from emotional decision-making and time constraints.

- Following an iterative process, we progressed from an MVP to the launch of the full version.

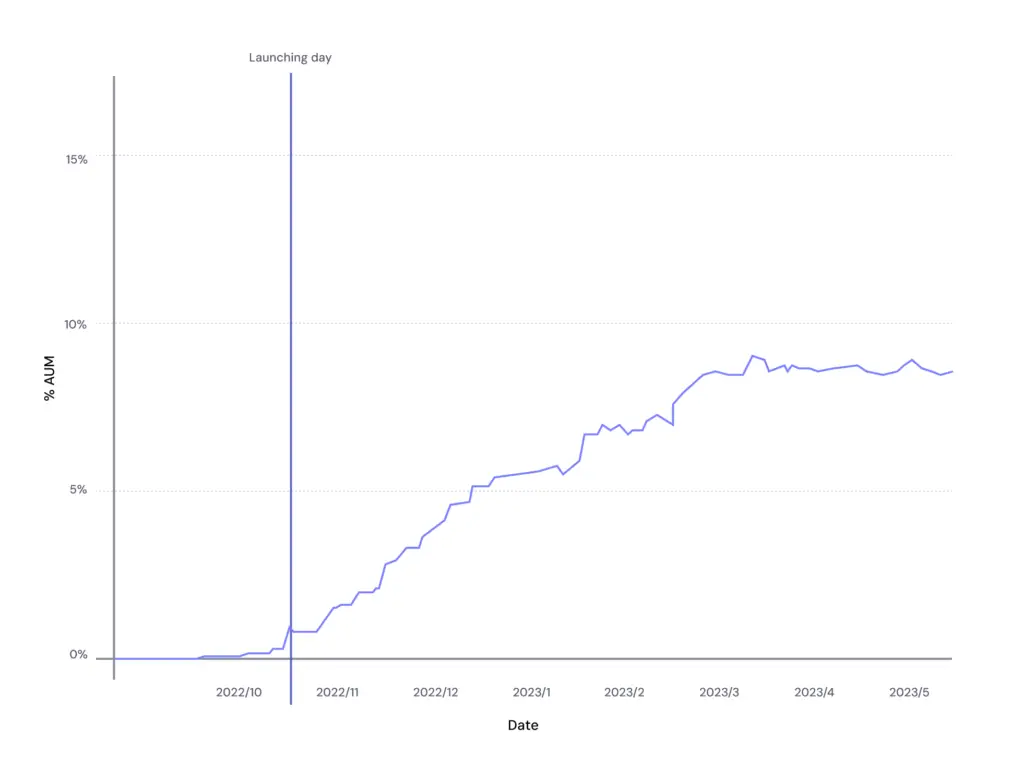

- After six months, the feature positively impacted business metrics, accounting for 8.69% of the assets under management (AUM) at Vest.

Context

Vest, a regulated broker-dealer in the U.S., developed an investment app to facilitate stock market trading for Latin American individuals. However, after launching the trading feature, we found that merely providing the tool was insufficient to boost trading activity.

The challenge

User interviews revealed that, despite interest in the benefits of investing, people were hesitant to engage actively for two main reasons: the emotional burden of decision-making, amplified by the fear of loss, and a lack of time to develop an investment strategy.

Solution

We implemented a robo-investing tool designed to deliver advisory services without the complexity, cost, and operational burden of traditional methods. As a regulated institution, Vest needed to apply for a Registered Investment Advisor (RIA) license, which set a two-month deadline from project kickoff to launch.

MVP - Suitability survey + Portfolio proposal

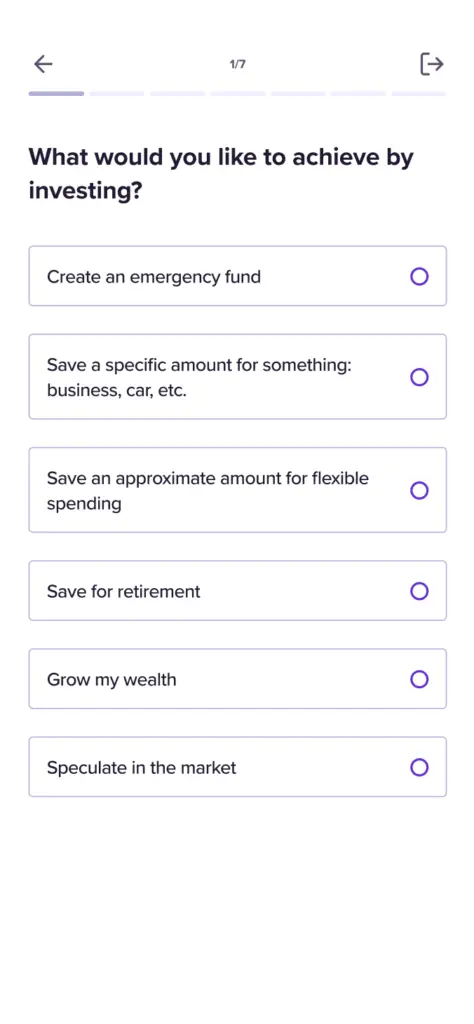

A robo-investing tool includes:

- Suitability & Risk Survey: Tailors a portfolio to align with user goals and risk tolerance.

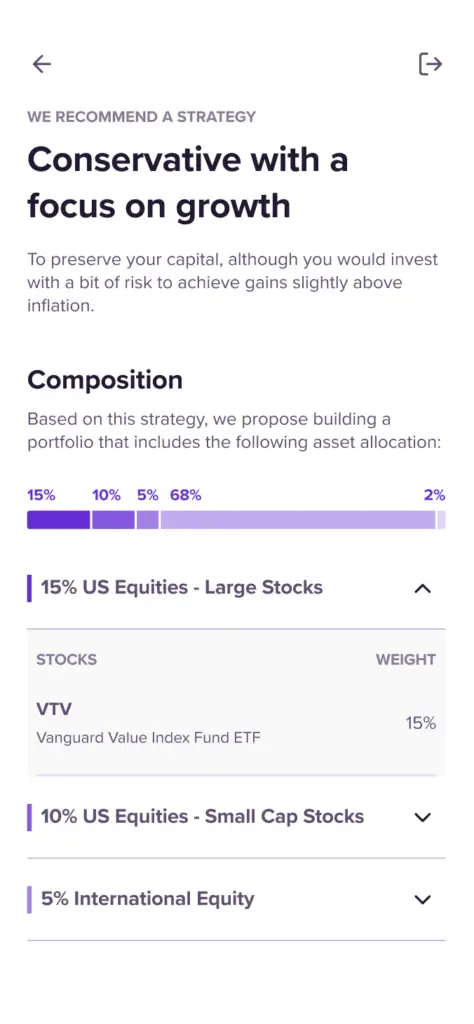

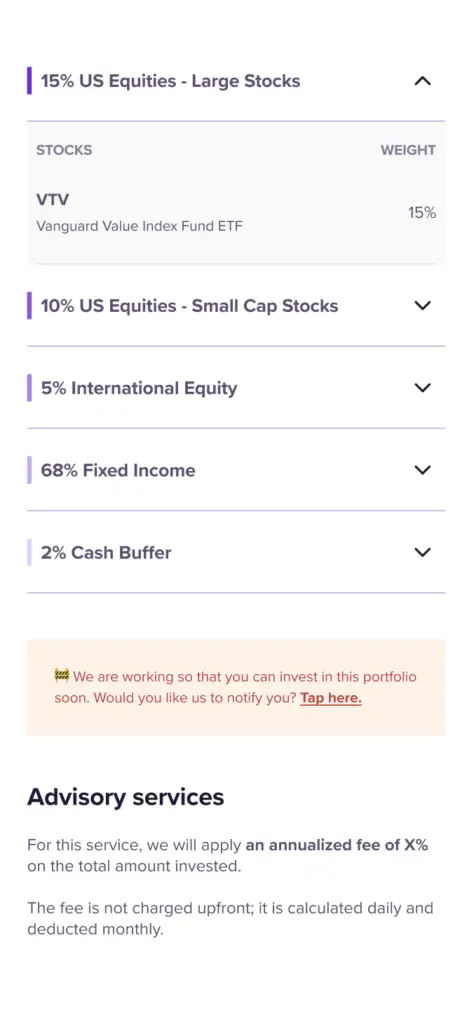

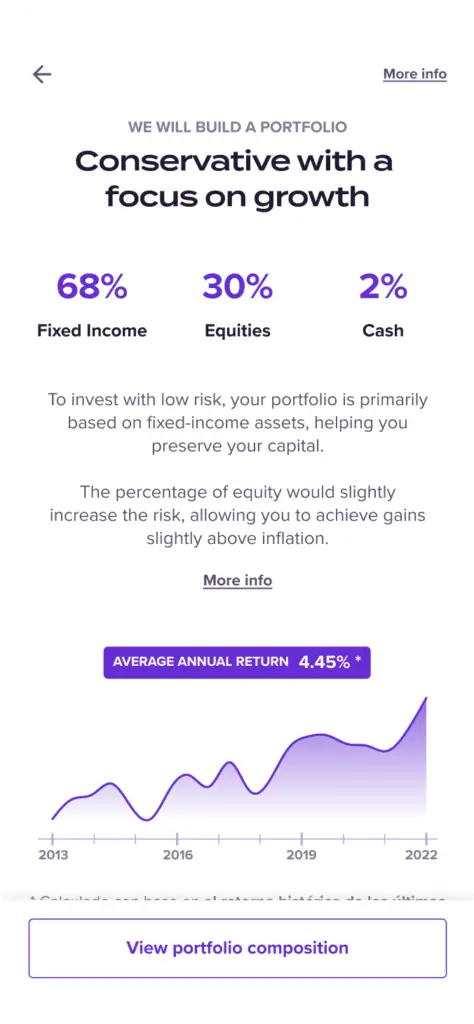

- Allocation Engine: Defines asset distribution within the portfolio.

- Rebalancing Service: Maintains asset allocation in response to market changes, ensuring alignment with user objectives.

As we began development and understood the complexity of the solution, we collaborated with the compliance team to define the initial scope as the profiling survey and portfolio proposal. This approach allowed us to meet the regulatory deadline, advance the overall feature, and deliver value to users.

While preparing for launch, we conducted usability testing sessions, yielding these key findings:

- Users with limited investment knowledge needed assistance with technical terms.

- Users sought more context regarding the rationale behind portfolio distribution.

- Users wanted to know the potential earnings from using the feature.

Overall, we received positive feedback:

… if it will save me the stress of not knowing what I’m doing with my money. I would definitely choose this option.”

… I enjoy investing, but I don’t have the time to manage it, so a proposal like this allows me to invest…”

… since I don’t know much, it’s more likely that I’ll lose more by my own than what this advisory service might cost me.”

… it encourages me to make the investment I want, right? And it helps me feel more secure about whether I made the right choice.”

We launched our MVP in record time, meeting regulatory requirements while delivering value to users.

Second iteration - Allocation Engine and Rebalancer

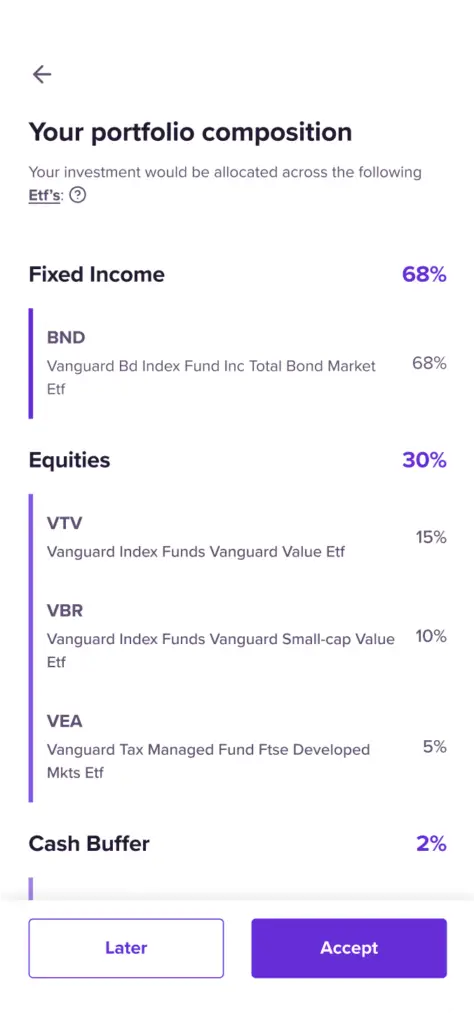

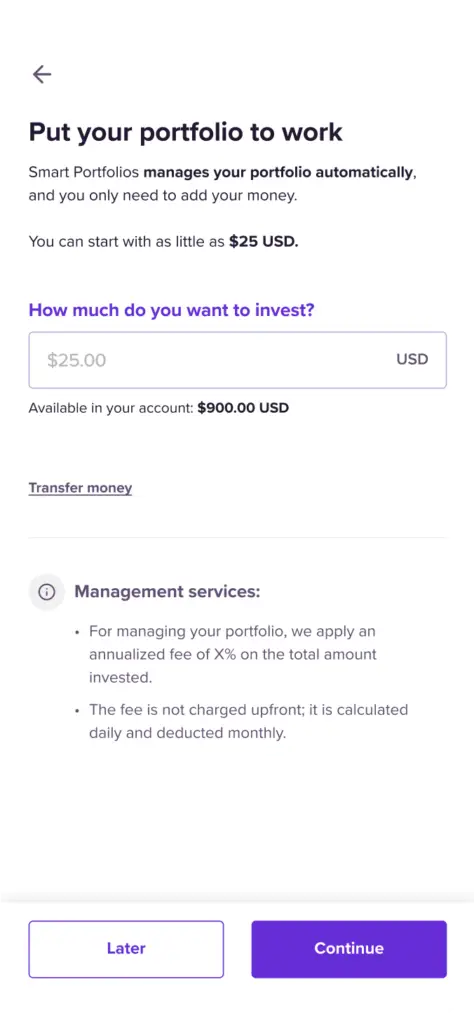

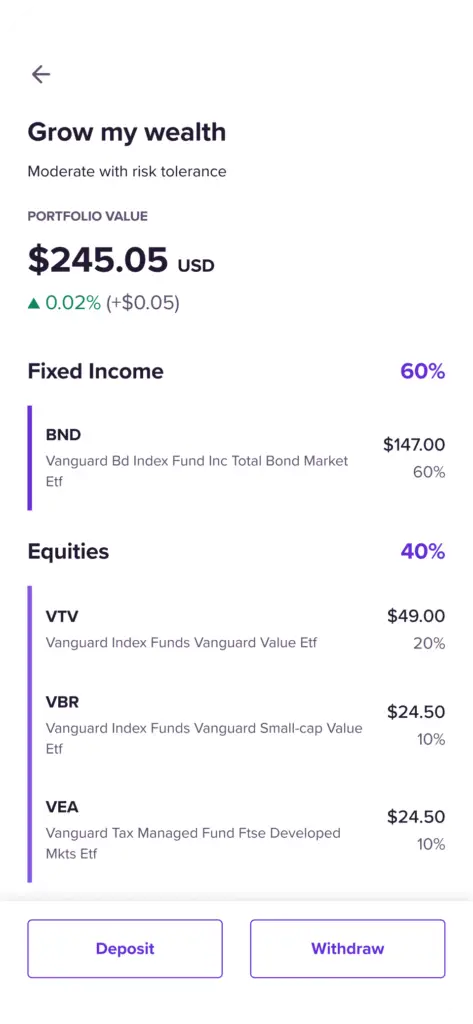

Now that users had tailored proposals, they needed to invest. In the second iteration, we focused on enhancing the allocation engine and rebalancer tool.

Users could now:

- Accept the proposed portfolio.

- Open their RIA account to hold assets.

- Deposit or withdraw funds from their portfolio.

- Enable Vest’s rebalancer to manage the portfolio, automatically executing buy or sell orders to maintain allocation.

We integrated insights from the usability session into the new flow.

Results

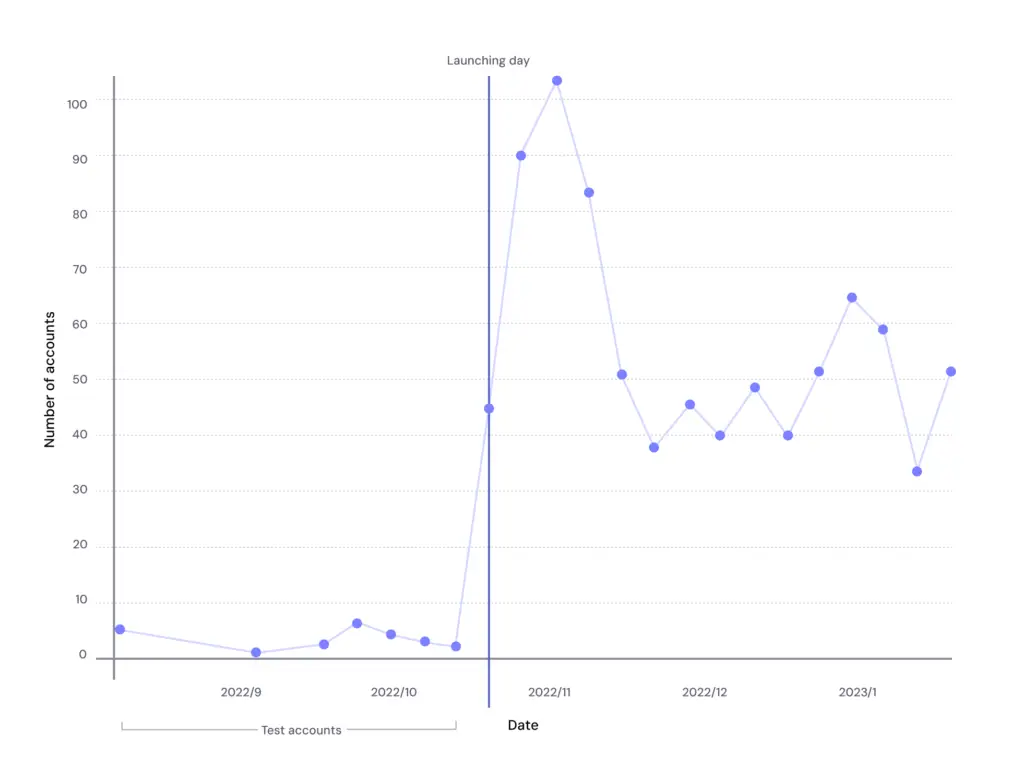

We received an incredible response from users, we were offering them a simple and straightforward solution to their main needs and pains. Within three months, 11.5% of users with an investment account had opened their RIA account.

After six months, the impact to the business metrics was notorious. 16.4% of active users had invested in their portfolios, and RIA investments represented 8.69% of the assets under management (AUM) at Vest.

Final thoughts

This project is one I am particularly proud of. The iterative process allowed us to make informed decisions, and close collaboration with the compliance team enabled us to effectively address user pain points. As a result, we not only positively impacted key business metrics but also provided users with a solution that directly addressed their needs.

KYC Flow Revamp: Boosting Activation Rates